Who Wins Warner? Agentic AI Answers

- Amir Bagherpour

- 1 day ago

- 6 min read

Updated: 11 hours ago

Anticipating the Warner Discovery Outcome Using Multi-Agentic AI Simulations

In this application, I developed a multi-agentic workflow to build a calibrated dataset, agent-based models, and simulations. I then developed an agent to infer and interpret the results from the models.

BLUF

Warner Bros Discovery Faces Likely Breakup as Bidding War Stalls

The battle between Netflix and Paramount to acquire Warner Bros Discovery will most likely end not with a single winner, but with the company's breakup. Regulators are expected to force a three-way breakup within two years, splitting the media giant into separate streaming, news and cable television businesses that would be sold to different buyers, according to a multi-agent stakeholder simulation analyzing 1,000 scenarios with varying market conditions and external shocks.

The simulation converged on equilibrium at "Position 40-53" on a 100-point policy spectrum, representing an alternative breakup or partial sale rather than either full acquisition. This outcome emerged despite—or because of—constant external disruptions: 74.1 percent of simulation rounds experienced major shocks from regulatory announcements, political interventions or financing issues. The model identified three distinct stakeholder coalitions: a Netflix alliance of 11 high-influence members favoring consolidation, a Paramount-led opposition bloc of 31 members seeking to block or constrain mergers, and a pragmatist cluster of 17 members positioned at the equilibrium point who favor competitive preservation through asset separation.

Neither Netflix's $82.7 billion bid nor Paramount's $108 billion hostile offer commands sufficient support to overcome the combined resistance of federal regulators, the Trump administration, labor unions and rival studios. The Justice Department and Federal Trade Commission, positioned at the restrictive end of the policy spectrum alongside President Trump, hold effective veto power and have signaled that either full acquisition would concentrate excessive market power. The simulation assigned only a 20 percent probability to Netflix winning with major concessions and a 10 percent probability to Paramount prevailing—outcomes that would require multiple low-probability events to align, including foreign investment approval for Paramount's Middle Eastern financing and antitrust clearance that defies current enforcement patterns.

The model indicates that the structural separation represents the stable outcome where no single coalition has enough power to impose its preferred solution, but enough stakeholders overlap to prevent indefinite gridlock.

The breakup scenario, which carries an estimated 65 percent probability, reflects the political and economic reality of modern media consolidation: No single buyer commands enough support among the dozens of stakeholders—from federal regulators and labor unions to rival studios and consumer advocates—to overcome resistance to a deal that would reshape the entertainment industry. The alternative outcomes—a full Netflix acquisition with major concessions or a Paramount victory—each face significant obstacles, including antitrust litigation, foreign investment reviews and shareholder skepticism.

Hollywood's Highest-Stakes Poker Game

Two titans are locked in a battle that will determine the future of streaming entertainment. Netflix has offered $82.7 billion for Warner Bros Discovery's crown jewels—HBO, Max, DC Studios, and Warner Bros Pictures. Paramount-Skydance countered with a stunning $108 billion hostile takeover backed by $24 billion in Middle Eastern sovereign wealth funds and a $40.4 billion personal guarantee from Oracle founder Larry Ellison.

I built a multi-agent simulation, ran 1,000 Monte Carlo scenarios, and deployed an AI agent to interrogate the results—mathematically inferring how this deal is most likely to break. The findings are surprising and reveal a core truth of modern capitalism: when numerous stakeholders with competing incentives and veto power collide, no one gets everything they want.

The Simulation Setup: Mapping the Battlefield

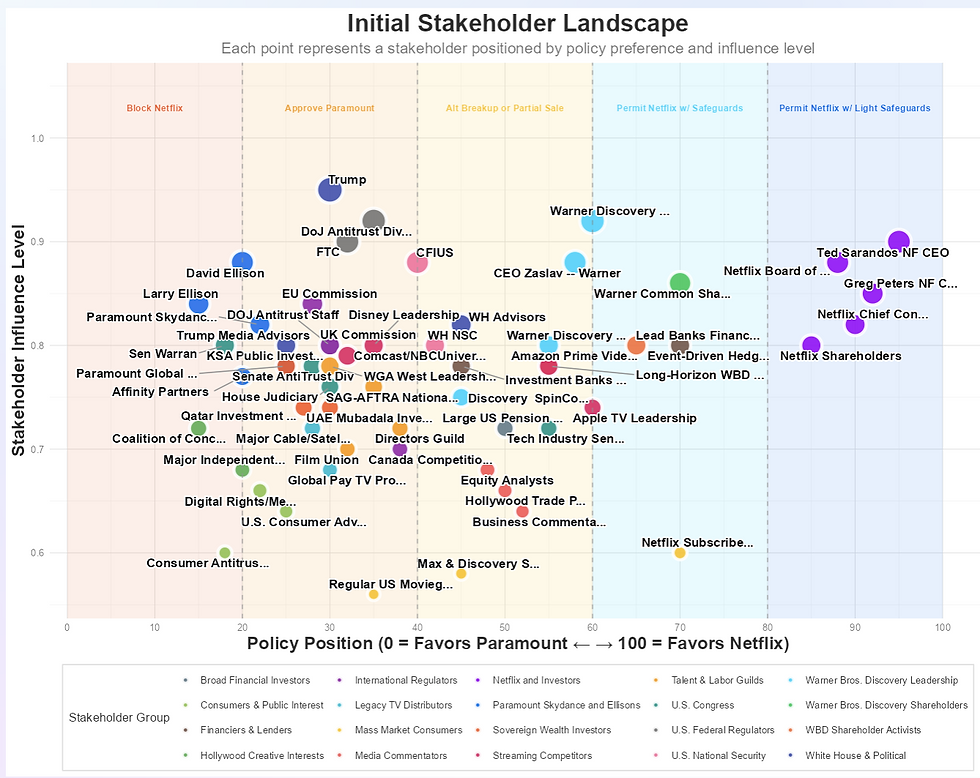

Using agentic workflow, I developed in-depth data on the 60 critical stakeholders across 20 distinct groups, each positioned on a 0-100 spectrum representing their preferred outcome:

The veto players are crucial. They include:

DOJ Antitrust Division (Position 35, Influence 0.92)

Federal Trade Commission (Position 32, Influence 0.90)

CFIUS - Committee on Foreign Investment (Position 40, Influence 0.88)

Warner Bros Discovery Board (Position 60, Influence 0.92)

WBD Common Shareholders (Position 70, Influence 0.86)

Current Landscape of Positions

What the Simulation Revealed: The Mathematics of Compromise

I ran the simulation for negotiation rounds with realistic dynamics:

Stakeholders with similar positions formed coalitions

High-influence stakeholders pulled others toward their positions

External shocks occurred with 75% probability each round (regulatory announcements, Trump statements, financing news, labor union actions)

Network effects created feedback loops (when powerful stakeholders moved, others followed)

Then I ran 1,000 Monte Carlo simulations to test robustness across different shock sequences, with shock variance of ±20% on positions.

Projected Landscape of Positions

Description: The landscape converges tightly around the alternative break-up policy range, signaling a stable equilibrium that favors structured alternatives over a clean win for either bidder. High-influence regulators, the White House, CFIUS, and Warner Bros. Discovery leadership anchor this center, constraining movement toward full Netflix consolidation while also blocking a Paramount-only outcome. Netflix remains cohesive but isolated on the far spectrum, unable to pull the median despite financial strength and internal alignment. The projected outcome is therefore a regulated breakup, partial sale, or heavily conditioned transaction, rather than outright approval of either bid..

The Mathematical Verdict: Alternative Breakup with Strong Safeguards

Description: The Warner Bros. Discovery Board’s simulated trajectory shows high volatility but a stable central tendency, with outcomes repeatedly oscillating yet anchoring near the mid-50s. Despite frequent shocks (≈75%), the mean final position settles at ~54, indicating a measured tilt toward permitting Netflix with safeguards, rather than a hard break or full consolidation. The wide distribution (σ ≈ 12.5; range ≈ 17–91) reflects sensitivity to political and regulatory pressures, but the lack of full convergence suggests persistent uncertainty and bargaining leverage, not a decisive commitment. Overall, the Board behaves as a pragmatic balancer, responsive to deal economics but constrained by antitrust and governance risk.

The simulation produced unambiguous results:

Mean Final Outcome: Alternative breakup or partial sale (Position 53.08)

95% Confidence Interval: Between "alternative breakup preserving multiple platforms" and "permit Netflix with significant safeguards" (Positions 38.7-49.4)

Standard Deviation: 11.45 points

Modal Outcome: Alternative breakup or partial sale with strong licensing protections and preservation of competitive platforms

Shock Frequency: 74.1% (constant external disruptions)

Translation: Despite 60 stakeholders starting at positions ranging from "fully block Netflix" to "endorse Netflix consolidation with minimal conditions," despite 74% of rounds experiencing major external shocks (regulatory announcements, Trump statements, financing developments, labor actions), the system gravitationally collapses toward a structured breakup solution—specifically:

"Alternative breakup or partial sale; strong licensing protections; preserve multiple competitive platforms; avoid single owner dominance"

This convergence occurs at the exact midpoint between:

Lower bound (Position 38.7): "Alternative breakup or partial sale" ← Regulatory preference

Upper bound (Position 49.4): "Permit Netflix with significant safeguards" ← Netflix's forced compromise

Network Dynamics and Deal Implications in the Warner Acquisition Battle

The network analysis shows that the Paramount–Netflix contest is governed less by bidder capital or intent and more by a dense web of brokers and influence pathways that shape collective outcomes. High betweenness and eigenvector centrality among CFIUS, the Warner Bros. Discovery Board, the White House advisory complex, antitrust regulators, and labor guild leadership indicates that these actors control the flow of influence across the system, effectively anchoring the deal space around a regulated middle ground. Media commentators, equity analysts, and trade press exhibit high closeness, meaning narrative shifts propagate rapidly and reinforce this equilibrium, while Netflix’s leadership—though financially powerful—remains comparatively peripheral in coalition brokerage. The result is a structurally stable convergence toward conditional or alternative outcomes such as breakups, spin-offs, or heavily remedied transactions, making a clean acquisition by either Netflix or Paramount unlikely under current network dynamics.

Conclusion

Across 1,000 simulated alternative futures — each buffeted by political interventions, regulatory announcements and different financing structure — the system stubbornly converged on the same outcome: Warner Bros Discovery broken into pieces, its assets divided among multiple buyers. This is a recognition of power distribution: when 60 stakeholders pull in different directions, the center cannot hold, and what remains is not anyone's vision but everyone's compromise. The media landscape of 2027 will be shaped not by the boldest bid or the deepest pockets, but by the cold logic of what competing interests can collectively tolerate.

Comments